Clark County assessor

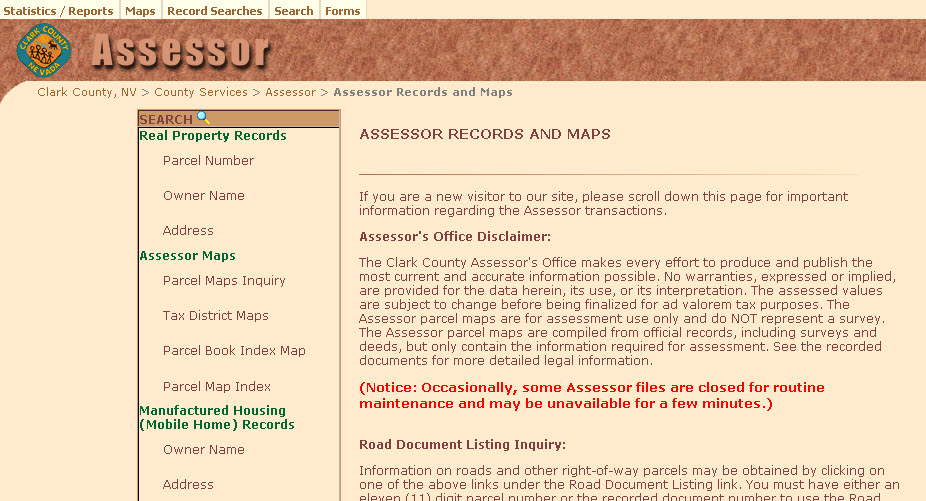

Our employees are empowered to improve themselves and the Assessors Office through. We hope that you find this system helpful.

Mike Clark County Assessor Washoe County Linkedin

Access code is required.

. Courthouse Square 401 Clay St Arkadelphia Arkansas 71923. The Clark County Assessors Office locates identifies and appraises all taxable property accurately uniformly and equitably in accordance with Indiana law. LAS VEGAS NV 89155-1401.

No warranties expressed or implied are provided for the data herein its use or its interpretation. CLARK COUNTY EXEMPTION RENEWALS. The Clark County Assessor will be offering assessment information online starting February 1 2021.

Suite 280 Athens GA 30601. Clark County Assessor Peter Van Nortwick is available to speak at neighborhood meetings and to business groups. Enhanced Enterprise Zone Application.

Clarke County Assessor Courthouse 100 South Main Street Osceola IA 50213 Voice. Physical Address 325 E Washington St. In no event will the assessor be liable to anyone for damages arising from the use of the property data.

The ACC Tax Assessors Office appraises all property located in Athens-Clarke County at its fair market value to ensure taxpayers pay no more than their fair share of property taxes. Charleston North Las Vegas Paradise Searchlight Spring Valley Summerlin. Boulder City Bunkerville Enterprise Glendale Henderson Indian Springs Las Vegas Laughlin Mesquite Moapa Moapa Valley Mt.

Skip to Main Content. Welcome to the Assessors Office. A C C E S S D E N I E D.

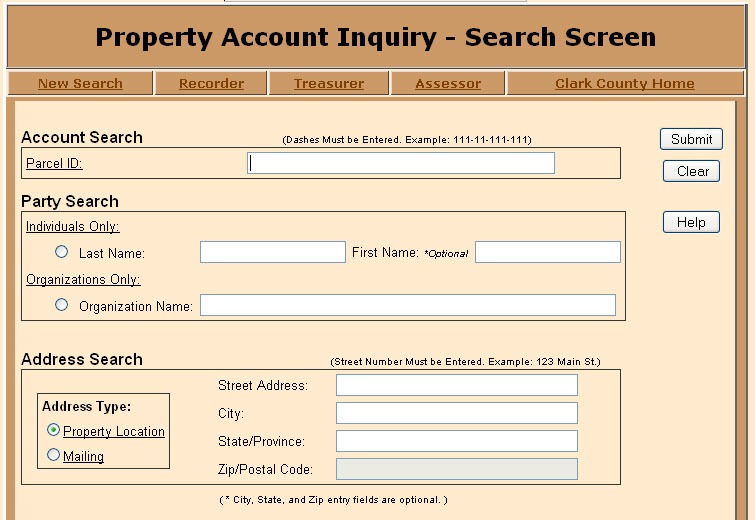

Please enter all information known and click the SUBMIT button. Clark County Auditor John S. Click here to search property records online.

PO BOX 551401. Clark County Property Tax Information. These values are used to calculate and set levy rates for the various taxing districts cities schools etc in the county and to equitably assign tax responsibilities among taxpayers.

The Clark County Assessors Office makes every effort to produce and publish the most current and accurate information possible. For tax year 2020 the complaint must be filed from August 3 2021 through. GIS Technical Support GISTechSupportclarkwagov 360 397-2002 ext.

Type your query in the box and click Go. Clark County Assessors Office 111 East Court Street Suite 120 Kahoka MO 63445 Voice. You assume responsibility for the selection of data to achieve your intended results and for the.

We serve the public with integrity in a helpful professional knowledgeable and timely manner. Federer announced today that Senate Bill 57 was passed and is a response to COVID 19. 4652 GISTechSupportclarkwagov 360 397-2002 ext.

CARES Act Second quarter application due no later than September 15 2020 Clark County Order No. People still have until next year to apply for the 3 percent tax cap. A Clark County assessor addresses the property tax cap situation.

We could not find your account. Ad Search Public Property Records In Clark County By Address. 830 - 430 pm.

I will notify the Assessor if the status of this property changes. FOX5 - Clark County homeowners have a June 30 deadline to update their information with the assessors office in. 2020-0401 Stay At Home Order.

The bill allows a property owner to seek a reduction in the true value of their property which is caused due to a circumstance related to COVID 19. If street number is entered results will include addresses within three 3 blocks. 12 hours agoLAS VEGAS Nev.

Clark County Assessor Lisa Richey. County Courthouse 501 Archer Ave. Need Property Records For Properties In Clark County.

Each year the Assessors Office identifies and determines the value of all taxable real and personal property in the county. Clark County Assessors Office 300 Corporate Drive Suite 104 Jeffersonville IN 47130 Tel. If you have questions or comments please call our office at 870 246-4431.

The Clark County Assessor may provide property information to the public as is without warranty of any kind expressed or implied. Marshall IL 62441. By renewing online you DO NOT need to mail in the attached postcard.

The assessed values are subject to change before being finalized for ad valorem tax. Enhanced Enterprise Zone Public Hearing UPDATE. RETURN THIS FORM BY MAIL OR EMAIL TO.

CLARK COUNTY ASSESSOR. 500 S GRAND CENTRAL PKWY. You can call us at 5643972391 or email at assessorclarkwagov to schedule.

Add What is the difference between a property tax levy and a property tax levy rate. If you are applying for a new exemption or do not have the required information please contact our office at 702-455-3882. Then click the ID number for your match to see more information.

/do0bihdskp9dy.cloudfront.net/06-30-2022/t_68fe42cc36134475bd7af06d9bab6e2b_name_file_1280x720_2000_v3_1_.jpg)

Zclisxxbpfu2pm

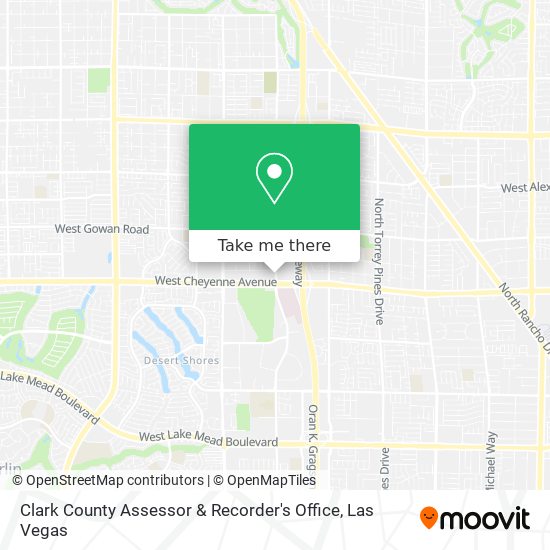

Clark County Assessor And Recorder Public Services Government 3211 N Tenaya Way Las Vegas Nv Phone Number Yelp

Clark County Assessor And Treasurer To Host Property Tax Town Hall Clarkcountytoday Com

Clark County Assessor And Treasurer To Host Property Tax Town Hall Clarkcountytoday Com

Clark County Assessor 3211 N Tenaya Way Las Vegas Nevada Us Zaubee

Mesquitegroup Com Nevada Property Tax

How To Get To Clark County Assessor Recorder S Office In Las Vegas By Bus

Clark County Assessor Briana Johnson Talks About Property Assessments In The Valley Youtube

Clark County Recorder Assessor Northwest Branch On Tenaya Way Now Open

Clark County Human Resources Facebook

Clark County Nv

Be Sure To Lower Your Property Tax By Filing A Primary Residential Tax Cap Claim Ksnv

Mesquitegroup Com Nevada Property Tax

Debbie Conway Clark County Recorder Runs For Her Fifth Term Veterans In Politics International

Clark County Assessor S Office To Mail Out Property Tax Cap Notices Youtube

Clark County Assessor And Treasurer To Host Property Tax Town Hall Clarkcountytoday Com

Clark County Nv